Retail reinvention: same store, new format

April 28, 2022

Retailers are doubling down on brick-and-mortar strategies that optimize space, address hyper-local needs, and provide immersive brand-building experiences.

As brick-and-mortar continues its post-pandemic climb, U.S. retailers are increasingly experimenting with store formats, replacing a one-size-fits-all strategy with customized store sizes that meet the evolving needs and expectations of consumers and the communities where they live. In today’s competitive market, staying relevant by innovating is critical to retailers’ success.

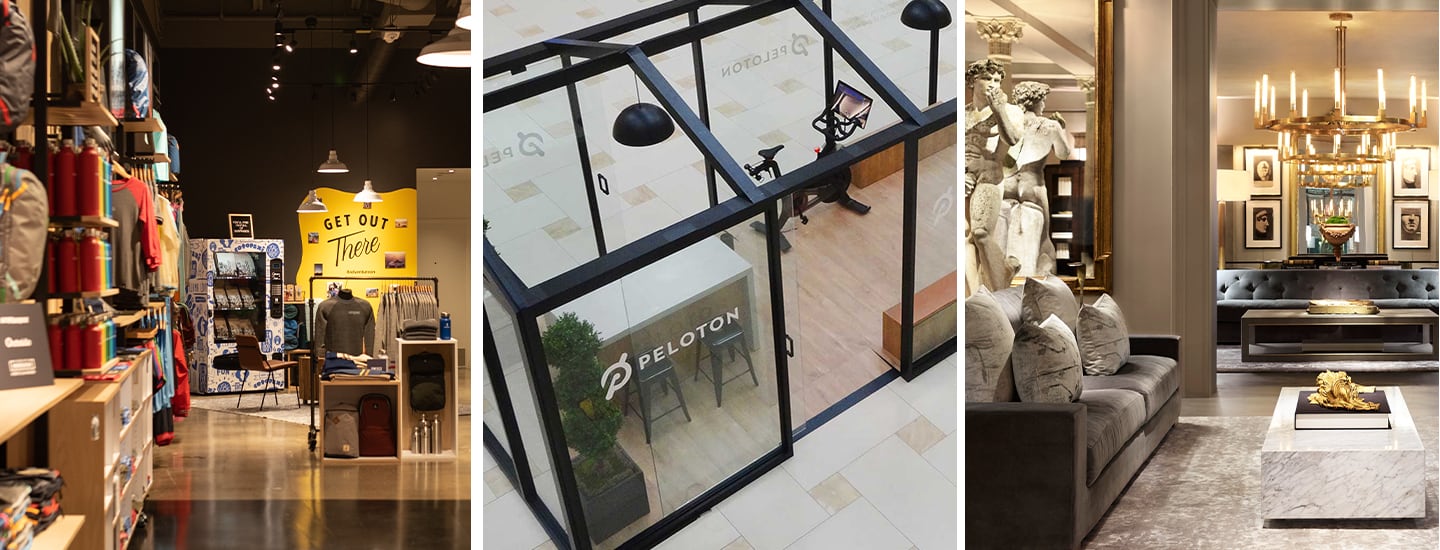

From small format stores that cater to a specific demographic to massive flagship stores that offer immersive brand-building experiences, and from big box stores that double as fulfillment centers to pop-up stores that offer tailored IRL activations, brick-and-mortar has evolved, expanded, and in turn, become a more efficient vehicle to drive growth.

Target Corp. recently announced plans to open 30 new mid-size and small-format stores, to reach new markets in suburban locations and densely populated urban areas like Times Square in New York. The retailer has already found success with its small-format college campus stores across the country, which offer a curated selection of school supplies, tech accessories, dorm room essentials, casual apparel, and grab-and-go food items. Similarly, Target’s new small-format stores will be stocked with goods tailored to meet the hyper-local needs of the demographics they serve — from young families to urban singles to tourists.

Meanwhile, Wisconsin-based Kohl’s said it plans to open 100 new smaller-format stores (about half the size of its typical stores) over the next four years. “We’re evolving our position from a department store to a more focused lifestyle concept centered around the active and casual lifestyle,” said Kohl’s CEO Michelle Gass in a recent presentation to investors.

Even Ikea is testing out the trend. In 2020, the Swedish furniture retailer announced plans to open 50 new smaller-format stores in urban areas around the world, including New York, Los Angeles, and Chicago. “This is how we have accelerated in our ambition to become more accessible,” Ikea Chief Executive of Brand Jon Abrahamsson Ring told the Financial Times. “It’s never going to be that we go back to only opening big stores. It will be a mix of formats, including smaller stores closer to where people live or work or move.” For Kohl’s and other traditional big box retailers, small-format stores allow them to enter a market that could not support a full-size store. A smaller footprint also means they can curate the shopping experience based on local consumer preferences and needs.

“It’s never going to be that we go back to only opening big stores. It will be a mix of formats, including smaller stores closer to where people live or work or move.”

Jon Abrahamsson Ring, Ikea Chief Executive of Brand

As retailers experiment with optimization and localization, there’s still a place for large format stores. At a time when supply chain issues are slowing deliveries, retailers with a big box presence are using the space to warehouse goods and offer customers same-day fulfillment and easy returns. Target’s mega “sortation centers” organize digital orders packed by local stores to enable next-day shipping in dense markets. The company, which opened its first pilot sortation center in Minneapolis in 2020, plans to add 10 new sortation centers and another four new distribution centers this year.

“Years of investment in our team and business have driven our sales beyond $100 billion and positioned Target to meet the needs of our guests no matter how they choose to shop,” said Target CFO Michael Fiddelke in a recent press release. “We see substantial opportunities to build on our core capabilities to drive deeper guest engagement and long-term growth.

Addressing growing consumer interest in experiential concepts, many luxury retailers are investing in massive flagship stores that offer curated, standout environments where shoppers can engage with brands in real life. Nowhere is that truer than at RH, which turned furniture shopping into a luxury experience with its integrated home furnishings/hospitality galleries. Last year, the brand opened RH Oak Brook — a stunning, three-level gallery featuring a glass-enclosed rooftop restaurant and wine bar and one of 13 RH design galleries across the country with hospitality offerings.

But RH is not an anomaly: pandemic isolation has driven demand for memorable, immersive brick-and-mortar experiences. Dick’s Sporting Goods — an early adopter of experiential retail — debuted a new interactive store concept last year. Dick’s House of Sport, currently located in Rochester, New York and Knoxville, Tennessee, features a running track, rock-climbing wall, batting cage, putting green, and more.

Even e-commerce stores are getting in on the brick-and-mortar act. Online clothing retailer Revolve recently opened its first retail store, Revolve Social Club, in Los Angeles, which features a lounge, gym, wellness center, bar, and café that offers free coffee and pastries with clothing purchases. And cult-favorite beauty brand Glossier opened a permanent store in Miami Design District this year featuring an “underwater” selfie room and a tropical-meets-Art Deco vibe.

Meanwhile, as demand for personal luxury goods continues to rise, luxury brands are accelerating their flagship store openings. Versace unveiled a new store in New York’s SoHo neighborhood last year; Gucci debuted several new stores, including one at Oakbrook Center; Balenciaga opened at Tysons Galleria in February and is set to open one of its largest flagship stores in Toronto later this year; and Saint Laurent is opening a mega flagship store on Avenue Champs-Élysées in Paris in 2023.

For retailers that want to test new markets, gauge customer interest in a new line or product, or try out a new experiential concept, pop-up stores are an ideal way to do it. The hyper-customized, data-rich environment of a pop-up allows retailers to capture the attention of consumers while using technology to connect with them directly and even transact sales. QR codes on products allow customers to make purchases using their mobile devices and have the items delivered the next day for a true omnichannel experience.

The pop-up format also enables brands to create seasonal venues and unique themed installations like Dior’s Italian Riviera-themed Dioriviera pop-up; Prada’s traveling pop-up, Prada Outdoor (garden, coast, mountain, snow); Dolce & Gabbana Hamptons, a customized airstream reminiscent of the Sicilian Cart; and Louis Vuitton’s vibrant men’s residency pop-up in SoHo.

Whether small or large, temporary pop-up or permanent flagship, curated store formats are a critical way for retailers to speak to customers and deliver products, services, and experiences tailored to their needs. In this new era of brick-and-mortar, the store itself has become the message.

Interested in taking your brick-and-mortar concept to the next level? Connect with us!